It’s coming in spring on 8 September 2020: the book you’ve asked for about teaching your kids how to manage their money.

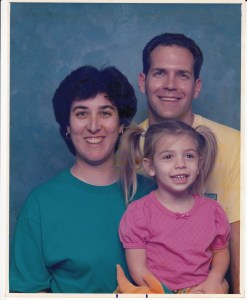

Life-long collaboration.

My daughter Carol and I recently signed a book contract with ChooseFI Media to publish “Raising Your Money-Savvy Family For Next Generation Financial Independence.”

It’s written from your questions asked at financial conferences, at meetups, and over many cups of coffee. Carol and I use a back & forth narrative describing our family’s financial parenting tactics versus her memories of how they really turned out.

We cover everything from allowances, chores, and jobs, to financial incentives, Roth IRAs, and college funds. We even describe a surprisingly effective way to help your teen save up for their first car.

You’ll learn how children think about managing their money. (Pro tip: they don’t share your goals.) You’ll learn how to avoid our mistakes, and how to recover from yours. We invented a technique or two that you might have never heard of.

Best of all, your kids will learn to manage their money by making their mistakes at home with you— instead of at college or in their first job. They’ll learn from their experiences, not just from your advice.

Frankly, you should find a copy of this book just to read the foreword. You won’t believe who wrote it– I can hardly believe it myself. Every time I write about this I get a goofy smile on my face just remembering how Carol and I made a very big request, and it all came together.

Let me share more about the writing & publishing process.

How did you get the idea?

I didn’t plan to write this book. In 2018 I was working on a completely different book, and I was also spending an occasional weekend at Camp Mustache or CampFI.

One afternoon I gave a talk about the mistakes we’d made with our investments while we pursued financial independence. A parent asked: “How did you teach FI to your daughter so that she can avoid your mistakes?”

CampFI: presenting right after breakfast.

I wasn’t expecting that question! By 2018 Carol had been out of college for several years and was well into her own Navy career. We parents are tremendously proud to watch her and her spouse make their way in the world, but we’d never thought that a bunch of other parents would want to hear about how we helped her launch from the nest.

As the parent sat there with an expectant look on their face, I babbled something about Marge and I giving Carol a lot of opportunities to manage her allowance and make mistakes before she left home.

A few months later I met that parent again and asked them if my answer had helped.

They said “Well, I tried giving them both an allowance, but they just kept wasting it. I gave up.”

Whoops. I was zero negative help. We talked a little more, and someday that parent may try again, but they clearly felt that my advice wasn’t working. (Yet.) Even worse, they’d lost confidence in exactly the same tactic that Marge and I had used with Carol.

Then Marge and I went to a CampFI in Little Rock. I highly recommend that location and the outstanding local attendees. At the camp, I gave my same talk about how we wish we’d invested in the 1980s and 1990s. The very first question was from a parent, and I already knew that they were raising a family big enough to form its own basketball team.

“How did you raise your daughter so that she can pursue financial independence?”

Oboy. No pressure.

I talked about all the classic mistakes that kids will make with money, and how parents can help them talk through their feelings. I made the point that wasting money as a kid is a lot cheaper than making the same mistakes in high school or at their first adult job, but some money would definitely be wasted.

Let’s face it: I was babbling at a slightly higher level, but I wasn’t much more help than before. That parent had a lot more practical experience than I do, and I don’t think they went home with new ideas to teach their kids how to manage their money.

After the talk, Marge looked at me and uttered those fateful words: “Nords, you need to stop whatever book you’re writing now and work on that money-savvy kid book.”

How did you and Carol start writing together?

When Marge and I visited Carol and her spouse in Norfolk, we told her about the CampFI talk and asked her the same question. “What did we do that really helped you learn to manage your money?”

Wow. She lit up! She had a dozen memories of what she liked, what had worked, and what didn’t. K.J. had noticed a few things about her money behavior in their marriage, and now he had the origin stories. Our dinner-table conversation took off and lasted for nearly an hour.

As we talked, I took notes. Later those bullet points went into an outline, and I asked Carol if she wanted to add her stories in her voice.

By the end of the week, we had most of a chapter. I realized that Carol was writing more than just her stories– she was a co-author. By the end of the following week, her insights made it clear that she’s the lead author and I’m strapped in for the ride.

Carol was a challenging kid to raise, but we write very well together. I might have more experience (I’ve had a three-decade head start) but she has a very strong voice. She’s a much better writer in her 20s than I was, and I’ve tremendously enjoyed our collaboration.

What’s different about publishing your second book?

The good news is that this time we had over eight years of blog posts before we started writing the book. Some of the blog’s stories and tactics went right into the book.

In 2005 (when Carol was a teen), I drafted The Military Guide over a leisurely four years. Sometimes I’d write a chapter in a few days, while other times I’d put the manuscript away for a few months. We’d occasionally talk about the book but it was just one of my projects tucked away among family time, surfing, and chores. Carol had a fantastic high-school English teacher, and his advice came home with her when she offered a few suggestions on the draft. That’s why The Military Guide has chapter checklists.

On this second book, Carol and I were averaging a chapter every two weeks. It was clear that this draft was going to dash to the finish line in about six months. (And it did!) Carol and I weren’t competitive about our collaboration (Marge is already rolling her eyes as she reads this) but we each had things to say and we were enjoying the conversation. This time Marge was editing the drafts of two authors, but let’s just say that Carol needed a lot less editing than her co-author.

In 2009 when I searched for a publisher of my first book, I spent nine months writing query letters in series instead of sending them out in a single blast. The good news was that I wrote a better query letter with every new attempt. The other news was that those letters were a lot of work. I knew that I could always self-publish, and I kept working on the next query letter. When Impact Publishing bought the manuscript the owner said: “I bought your manuscript because your query letter has a great marketing plan!”

In 2018 we already knew the personal-finance publishers. We didn’t even write a query letter. This time it really helped to be a published author– and that can really go to your head.

Creatives working hard all day long at FinCon18 in Orlando.

It started at FinCon18 in Orlando. I was catching up with friends, and one of them is an executive at a very successful company with an indie publishing branch.

Exec: “What have you been up to, Nords?”

Me (smiling and sipping coffee): “It’s a funny story. My daughter and I are writing a book.”

Exec: “Really? We’d like to publish it!”

Me (nearly blowing coffee out my nose): “Um, wait, what? Would you like to know what the book is about?”

Exec: “Personal finance, right?”

Me: “Well, yeah, and this time–”

Exec: “That’s why we’d like to publish your book. Let me know when you’re ready.”

A typical CampFI reader focus group.

In May 2019, Marge and I attended CampFI Mid-Atlantic. (I highly recommend this conference too, because stand-up paddleboarding on the James River! Oh, and it’s also a great weekend with a fun crowd of people pursuing FI.) This time my talk was about raising a money-savvy family, and I mentioned that Carol and I were writing the book.

Brad Barrett and Jonathan Mendonsa were in the crowd. I knew all about their ChooseFI podcast, of course, but I didn’t realize they were growing the company in all media directions.

Jonathan tracked me down after my seminar.

Jonathan: “Nords, we’d like to publish your book!”

Me: “You guys are publishing books?!”

Jonathan: “We are now!”

Carol and I had a lot to talk about.

In September I spent most of FinCon19 (Washington DC!) networking in real life with my fellow money nerds, as usual. I also spent hours with those two publishers talking through all of the book questions. Every day Carol and I chatted back & forth across the time zones to figure out our priorities. Deciding between these publishers is like trying to choose among Olympic athletes.

Ironically for a group of personal-finance experts, we did not talk about the money. Nobody was competing on royalty rates or marketing services or even the size of the stretch limo for the book tour. Instead, we were comparing our audiences and trying to decide how to reach them.

We all agreed that ChooseFI has the family audience who is most likely to buy the book by the container-load. (And the eBook. And the audiobook.) Military families will enjoy it, of course (because our daughter grew up in one), but our ideas and stories appeal to all families.

Better yet, ChooseFI Media has MK Williams. She’s just self-published her fourth novel, and her third book is a thrilling suspense novel about… of all things… financial independence. (No, seriously, read the book. When you’re pursuing FI, the allegory is hilarious.) Best of all, she’s published the FIology Workbook with David Baughier. David and his family visited us last summer, and we chatted for hours about what it’s like to work with MK.

It’s all good. And I’m not just saying that because MK has a gigantic marketing spreadsheet of all the tasks which Carol and I (among several others) need to wrap up before this book gets printed.

I highly recommend MK and ChooseFI Media. If you have a manuscript to submit to her… then please wait until after our Money-Savvy Family book is out. (Just kidding. Maybe.) Carol and I are well on our way and MK’s building a publishing powerhouse.

What’s next?

Screenshot of the editing in progress… all right, back to work.

We’re wrapping up our second round of editing and heading into the line edits. (We’re still anticipating the copyediting, yay!) If everything goes well then the print and eBook editions will be in press by spring 2020.

The audiobook comes after that. Please let me know if you have James Earl Jones’ contact info, because otherwise, you’re going to have to put up with my voice in between Carol’s sections. I’m sure the audio engineers are looking forward to stitching together those voice files.

In a few weeks, we’ll be ready for your feedback on the cover designs. Speaking as a nuclear-trained submariner, you do not want me making those decisions. Carol and MK might be looking forward to your help even more than I am.

We’d especially like to thank the beta readers of the CampFI Alumni Facebook group. Your feedback and polling votes helped guide the book through the usual rocks & shoals of editing. It’s one thing to exclaim to a publisher: “But you’ve never seen a book like this before, and we’re special snowflakes!” It’s quite different to respond: “Here’s what the reader poll data and other feedback is telling us. And by the way, these people are already trying to pre-order the book.”

Finally, in January 2020 Carol and K.J. are launching one of the world’s most innovative book-marketing tactics. Follow this blog’s social media channels– and prepare to be amazed!

[earnist ref=”the-military-guide-to-financial-independence” id=”70177″]

Related articles:

Start a Roth IRA For Your Kid

Early retirement and the kid’s college fund

Raising a money-smart kid

Raising an ER-smart kid

Retiring Early — with Kids?

Family Estate Planning For Your Disability

“I Inherited Money And Now I Can’t Blog About Financial Independence Anymore”

Enemies of Peace (by MK Williams)

The FIology Workbook (by David Baughier and MK Williams)