This is a financial independence Public Service Announcement for:

“Abilities you never knew you lost until you regained them.”

If you’re a military veteran, and if people (other than you) think that you’re losing your hearing, the VA could give you a free set of hearing aids. They’ll pay your expenses even if you’re already financially independent and can afford to buy your own.

The VA considers hearing aids to be “assistive tech” just like prescription eyeglasses, dental crowns, orthopedic braces, hiking sticks, or any other prosthetic device.

“Free” means that you don’t even need a VA disability rating. You don’t need to file a VA disability claim, and you don’t need to use the VA for your healthcare. (You can still do those things if you want to, but you should get the hearing aids as soon as you need them.) The VA buys the gear in bulk and then schedules military vets for free hearing exams. If your audiogram shows that you need hearing aids, you’ve already paid the (physical) price for them.

Admittedly the VA might have an ulterior motive: hearing aids today make it easier to care for you tomorrow.

When you need hearing aids, the VA would greatly prefer that you start using them now. Waiting until you’re older (and deafer) just makes it that much more difficult to help you cope with what you’ve already lost. There’s even a correlation between hearing loss and worse issues like declining cognition, balance problems, and falls.

Speaking of “waiting too long”, I learned that in my usual manner: the hard way. Just ask my family.

Signs that you might want hearing aids

In my 50s my hearing was as good as ever, especially compared to other submarine shipmates. Yet as my 60s approached I noticed that a lot of customer-service staff had started muttering and mumbling. I even began wearing a headset for phone calls & podcasts because my earbuds (let alone my iPhone’s speakers) were no longer doing the job.

When the pandemic started, my hearing loss made life much harder for me– and for my family. Submarine vets have spent their entire careers practicing self-isolation and social distancing, but it soon became clear that my hearing was a problem for everyone.

Once I’d received my vaccinations and ventured out again with a facemask, I quickly realized how much hearing I’d lost even before the pandemic. When everyone else is wearing facemasks, it’s a lot harder to read their lips and facial expressions. Maybe they were muffled behind their N95s and the plexiglas shields, or maybe I was struggling to hear them even before that interference was in place.

These days my hearing aids help me regain the sounds that I hadn’t realized I’d stopped hearing.

“Lost hearing” is a subtle point. Restoring mine helped me appreciate how much I’ve lost, despite decades of seeing the evidence on my audiograms. In retrospect, I wasted a few years on whining & sniveling before getting fitted.

Although the gear greatly improves my hearing, I’m still working on my listening.

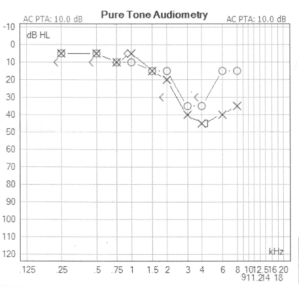

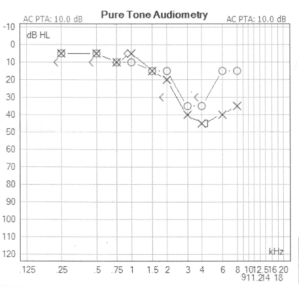

The first step: an audiogram

The audiograms are pretty much the same as active duty exams, only this time you don’t have to worry about being grounded or even disqualified. It’s a great opportunity to have a full-disclosure discussion with an audiologist.

Try not to get here.

Once I reluctantly decided agreed to try hearing aids, my audiogram quickly attracted the wrong kind of attention.

If both of your ears lose 30-40 dB of acuity, that’s all too common with chronic occupational exposure to high noise levels– and from aging. However if one ear loses more than 15 dB beyond the other, then you end up with your head in a MRI machine (contemplating your life choices) while the radiologist checks for polyps or an acoustic neuroma. (An acoustic neuroma has already killed at least one other submariner.) Ironically the MRI hardware is so noisy that you wish you could wear hearing protection.

(Note to submariners: as an Engineering watchstander, my left ear spent a lot more time pointing toward noisy enginerooms than my right. I shoot long firearms from my right shoulder. And yes I rigorously wore hearing protection.)

I don’t have acoustic polyps or tumors, but if I hadn’t dragged my feet for so long then an earlier MRI exam might have noticed a bunch of (unrelated but serious) sinus problems. Earlier detection could have led to faster treatment of sinusitis scarring (while avoiding more VA disability compensation). That’s a lessons-learned story for another post.

Even worse: because my left ear is significantly worse than my right, I lost most of my azimuth & elevation discrimination. I could still match noises to bearings with my eyeballs– if I heard the noise– but I couldn’t hear people approaching from behind me. I only found out when they spoke up… or when I started moving and bumped into them.

That particular aural deficiency led to several regrettable domestic incidents over the years. I’m still apologizing to my spouse and my daughter.

I’ve eventually learned to head-check my baffles and rotate my body in place before I step out. Yet every time I discovered someone behind me I felt simultaneously ambushed, antagonized, and apologetic. Nobody was happy.

As I told the audiologists on my first visit: “I’m here at the request of my family.”

The whole team smiled, and the doctor said “We hear that a lot.”

Getting the ear gear

Surprisingly easy to use.

I’m sporting a pair of Phonak Audéo L90-RLs. (That link goes to the owner’s manual. If we meet up in person, feel free to ask me to show them off.) They’re a 75-year-old Swiss medtech company and their full package (with batteries & accessories) retails for ~$3000. The audiologist claims that Phonak currently has the most reliable Bluetooth code (more on that later) plus decent water & sweat resistance.

After the audiograms, getting the hearing aids still took a couple of appointments. The first one measured the size of my earlobes and external ear canals. This determines the size of the hearing aid’s shell, the length of the wiring to the amplifier by your eardrum, and the diameter of the support dome holding that amplifier centered over your eardrum.

We also consulted a color wheel to choose a shell tint that, um, nicely complements my skin color and what’s left of my silver-fox hair. The shells are neatly hidden behind my earlobes, mostly under my hair. They’re smaller (and a lot lighter) than a shelled almond.

The second visit spent about five minutes checking the physical fit. (Note to Navy & Coast Guard veterans: despite our maritime red/green running-light standard, hearing aid amplifiers seem to be red on the right and blue on the left.) 15 minutes went into synching the electronics to my audiogram. Most of my amplification is from 4-8 Khz, and my left aid is cranked up 15 dB higher than my right aid. The audiologist tweaked those parameters on their diagnostic computer system.

While she set up the electronics, I downloaded the myPhonak app on my iPhone. (Of *course* there’s an app for that.) In addition to the “Automatic” default it offers settings for Restaurants, Music, TV, Calm environments, and my favorite: “Bluetooth streaming + mic.”

Phonak uses three Bluetooth connections: one for controlling each aid and a third for connecting them to other audio devices. In my case, the right hearing aid happens to run most of the Bluetooth code for controlling both hearing aids, which drains the right battery a little faster. At the end of the day the charge on the right battery is 10-15 percentage points lower than the left battery.

It took me a long time to understand the third Bluetooth connection’s potential: it offers both a virtual headset (with a virtual microphone) and stereo headphones. The technical term is “hands-free AG audio” with my desktop personal computer acting as the audio gateway to handle Zoom calls.

Now I can use my hearing aids as an expensive headset or earbuds– and their Bluetooth works a lot better with a Windows PC than the Bluetooth on my expensive Jabra headphones.

The headset mic handles speech largely through bone conduction, and the quality is similar to the condenser mic on corded earphones. Both of them go through the hearing aid’s Bluetooth (instead of the phone’s external mic). I’ll still use a podcast mic for my vocal contribution to high-quality audio recordings, but it’ll be nice to record audio (and video) without an entire headset strap across the top of my skull.

Stereo headphones are what you’d expect, without much bass driver. The hearing aids are great for text tones and phone calls, or for listening to podcasts & music. For full-spectrum audio you’ll still want to use external speakers.

Phonak’s app even includes a movement tracker: now I can count my steps with my hearing aids instead of carrying my phone. Phonak’s corporate partners also helpfully upsell their health tools of interesting cognition games, better sleep, improved focus, and “More coming soon!” Yay?

Cognition is an important reason for hearing aids. Research shows a moderate correlation between hearing loss and declining cognition, especially leading to dementia. The theory is that if we can’t clearly hear (let alone parse) the activity around us, then our brains work even harder to try to understand our environment. The extra effort quickly leads to that dead-tired end-of-the-workday feeling of cognitive depletion. Eventually we withdraw from society and gradually lose the ability to communicate. Audiologists and neuroscientists don’t fully understand the causation but I’m not willing to experiment with the risk. I’d rather wear hearing aids now and choose to selectively withdraw from society on my own introvert terms.

(Intriguingly, Phonak’s app used to have a setting for “Find my hearing aids” which might have been dropped from the latest version over privacy concerns. When I’m wearing them, that feature could be used by family to keep track of an elder’s location. I think it’s far better than putting Apple AirTags into footwear or wallets.)

After the audiologist walked me through the app, we spent another 20 minutes tweaking my hearing aids. Their tiny Li-Ion batteries last about 20 hours (longer than I do) before recharging overnight, and the gear includes a wireless charger to hold them when I’m sleeping. There are also consumables to swap out every month or so. I learned how to replace the speaker’s tiny earwax traps, the open dome over the speaker (for a better fit in your ear canal), and the plastic molded retention tail that stabilizes the aid in the ear.

For those military veterans who are tired of dealing with the traffic around the VA’s Matsunaga clinic at Tripler Army Medical Center, I highly recommend our brand-new Akaka clinic in Kapolei. Traffic is light (compared to the Honolulu area) and parking is plentiful. It’s only a few minutes away from White Plains Beach, too.

Once the audiologist thought I had a handle on the gear, she handed over my goodie bag and I was released to enjoy my better life.

Daily life with hearing aids

I wore them home from the audiologist, of course, and spent Day #1 being amazed by every sound. (Probably with a goofy smile on my face.) I can (re)hear rainfall on leaves & grass (not just on gutters & sidewalks). I can hear our neighbor spraying water from a garden hose, and their laundry dryer’s buzzer when it finishes. (“They have a buzzer?!?”) I can hear my spouse’s approaching footsteps before she enters the room. Once again, I can tell when people are walking behind me.

I can even hear my spouse moving around the other end of the house or opening the garage door. She’s not sure how she feels about me regaining my enhanced counterdetection ranges.

In other news, as I walk I can hear my heels hitting the ground (or scuffing it). Chewing food (let alone ice cubes) is a completely new experience coming through both the hearing aids and bone conduction. Birds and geckos are noisier than I ever remember. I can hear my PC’s keyboard keys clicking on their backplane.

Ironically I’m still hyperaware of transients: dripping faucets, flow noises, motor bearings, and slamming doors. (That definitely comes from submarine sea duty.) I’ve continued to hear these noises every step of the way through hearing loss, even as I was losing the ability to hear conversations in a crowded room. However now I hear transients even more clearly, and once again I can pick out a quiet conversation from the noisy crowd.

When I’m listening to my PC or iPhone’s audio and the soundtrack ends, I can still hear the audio carrier wave in my hearing aids. I don’t know whether that’s always been on the PC’s external speakers or in the headset earphones. Maybe it’s a design of the “Bluetooth steaming + mic” software.

When it’s very quiet in our house or yard I’ll occasionally hear a slight electronic echo in my ears from the hearing aids trying to amplify the background. (Well, I’ll hear it when my tinnitus abates a little.) At first my left hearing aid reverberated more often than my right, which gets annoying. After a few weeks I e-mailed our local VA clinic’s Audiology department for an appointment to tweak that setting, and that quiet reverb is no longer an issue. In quiet places I can also use the app’s Calm setting to back off the amplification a bit.

My ears mostly adapted to the app’s Automatic settings over the next 4-6 weeks, and I can adjust each of the app’s amplification levels on my iPhone. Blog posts and YouTube have plenty of tutorials for hacking the settings on your hearing aids or the app. Of course I can return to the audiologist for more detailed experimentation on their special-purpose software. I’ll also get a new audiogram every year or two.

You’d expect that my earlobes and ear canals would feel the skin contact or the rubbing. I was subliminally aware of that for the first few days, and now I don’t notice it. It’s even worse than that: at the beach I have to confirm I’ve removed my hearing aids, not just my wallet and my car’s key fob. When I go to bed, I have to remember to remove my hearing aids (and put them on the charger) or they’ll wake me up with their low-power alerts.

Potential pitfalls of hearing aids

Speaking of audiologists: be aware that your hearing aids log your user hours.

After six weeks of hearing-aid experience I had a followup session with the local VA’s audiologists. They use a paper questionnaire asking (among other things) how often and how long I wear my hearing aids. During our discussion they asked for more details of how many days, how long, and when & why I remove them. While they were checking my hearing aids in another room, I answered with the facts: I’m wearing them all day unless I’m napping or surfing.

It turns out that my hearing aids also record those run hours, and they can rat you out. When the audiologist returned from checking the hearing aids, she actually smiled at me: “Your hearing aids verify what you’ve told us. You’re doing a great job with your hours. This is my happy face!” Apparently the audiologists have way too many veterans lying to them about how much they actually use their hearing aids.

Hearing aids are great for clarifying audio, yet they still have their limits.

Among the VA’s choices in hearing aids, some of them are MFI: Made For Iphone. My Phonaks are specifically *not * MFI, but I’ve seen at least one model of Oticons that are MFI.

MFI hearing aids integrate wonderfully with iOS devices. Unfortunately MFI hearing aids don’t stream with Windows OS. There are rumors that Win11 will be able to stream audio with MFI hearing aids, but until that happens I’m sticking with hearing aids which work directly with a Windows PC. If you’re a Linux user… well, you already know you’re on your own.

When I want to feel the vibrations of classic-rock bass and percussion in my skull, I still need a set of car speakers or a subwoofer. (Now I understand why so many musicians are wearing hearing aids.) I still have to figure out how I want to use hearing aids on airplanes, but I’ve read that most people use headphones. When I’m flying, though, I’d rather read or sleep than listen to audio. It’s even worth removing my hearing aids to put in earplugs, but over-the-ear muffs can do the job too.

I regret that hearing aids are not yet ocean-friendly. Their “water resistant” rating (and their warranty fine print) is more about heavy rain (and heavy sweat) than the action at my favorite surf break. However if I wiped out on a wave then I’d lose them on my first faceplant. Unfortunately my friend Uncle Bob at our White Plains Beach surf break is even more hearing-impaired than me, so when we’re out on the waves together (with only salt water in our ears) we mostly just say “Nice wave!” to each other. We’ll save the detailed analysis for when we’re back on the beach with hearing aids.

I’ve learned that the VA will usually replace a set of hearing aids for free: once. After that you’ll have to provide your own until you’re off the penalty list.

How your Bluetooth audio looks to everyone else

Now that I use hearing aids, my phone calls look exactly like talking to myself in public. (“Finally, an excuse!”) When I get a call I’ll look away from whatever I was doing, say “Hello”, and start a random conversation.

As a newbie hearing-aid user, when I forget to turn down the ringer on my phone then the loud ringtone of an incoming call makes me jump & flinch. I’m getting better about that.

When I’m with family or friends, I’ve learned to hold up a “wait a second” finger and say “I’m getting a call.” If it’s more than a couple of sentences, I’ll walk away from our group (maybe even to another room) to finish. In public, though, I’ve learned to pull out my phone and hold it near my chest, even though the Bluetooth connection doesn’t need it. People see me talking at my phone and realize (as far as they can tell) that I’m on a call.

When I’m streaming audio from my PC, people can’t hear it and might not be able to see my screen. With my family, I can hold up my hand in a phone-call pose, say “Wait a second”, and shut off the streaming audio to talk with them face-to-face.

When I tried this phone-call hand with our neighbor, a nine-year-old who frequently visits us, she looked at me and asked “Why are you giving me a hang-loose shaka?” She’s never in her life seen an adult hold a landline phone receiver up to their ear.

Before hearing aids, if I tried to listen to music with headphones or earbuds, I was always struggling to keep them from slipping around or falling out. Now when I’m doing mindless chores or yardwork, it’s easy to stream music from my iPhone (in my pocket) without worrying about tangling cords in the shrubbery (or in the blades of my hedge trimmer). But again, to the rest of the world it looks like I’m singing badly or whistling while I work. At least people will make eye contact with me and wait for me to shut off my noisy tools (and mute my phone) so we can talk.

When I’m driving the car with a passenger, I have to think about the navigation software. Its voice can be on the car’s speakers, on the phone’s speakers, or… only in my hearing aids. If I forget to use an external speaker with navigation then I’ll be deep in a conversation with my passenger and suddenly have Siri talking in my head. (It reminds me of submarine watchstanding when three people will call out reports to you at the same time.) If we’re doing can’t-miss navigation on busy roads then it’s best to switch to an external speaker so that your passengers know when to stop talking and help the driver.

When I’m driving alone, I connect my iPhone to my car’s sound system and blast classic rock through multiple JBL head-pounding speakers. That way if Siri needs to give me directions (or if anyone calls or texts) then my iPhone and my hearing aids will automatically mute the music to let someone else talk. Of course that always happens during the best parts of a solo.

Other hearing aid options (not from the VA)

For fashion-conscious military veterans, I regret to report that the VA does not offer Headbones, Deafmetal, or Vulcan (elf?) earlobes.

(I’ll enjoy watching search-engine algorithms deal with those keywords!)

I’m keeping an eye on those avant-garde trends. I’m not concerned about this aspect of fashion, but I’m certainly interested in a waterproof version that’s tightly connected to my earlobes. As more Gen Xers and Millenials get fitted for their hearing aids, maybe we’ll see better options for surf-friendly hearing.

A reader testimonial

When I posted about hearing aids on the Millionaire Money Mentors forum, I got lots of advice from other hearing-impaired users. When I started posting about the VA’s free hearing aids, I also got this note from a happy reader:

“I just wanted to thank you for a post about the hearing aids you got from your VA health benefits. My dad is 87 years old and has worn hearing aids for some time. He also can’t hear very well even with them. Unfortunately, his are getting old and with only a small pension and their Social Security income, it’s financially difficult for him to get a new pair.

After reading your post and how well you like yours, I decided to see if my dad qualifies for VA health benefits. He was in the the 1960s Army Reserves with about six months of active duty. He never applied for VA benefits because he assumed that he wouldn’t qualify with his limited active duty time. I took the time to apply and sent in his DD214 form. Yesterday, we learned that he qualifies and now will get benefits!

His insurance and Medicare won’t cover new hearing aids, so I’m very curious to see what the VA might be able to do for him.

I don’t know what all is included with his VA benefits. He is supposed to get a packet in the mail within 30 days, but I’m really hopeful he will benefit from a new set of hearing aids. I’m also very curious to see what other benefits he might be able to use for the remainder of his life. I only wish I had submitted the application years ago.

Thank you again!”

Life lessons from hearing aids

I’ve had several reminders of another benefit to this pursuit of better health. My Medical Commando missions over the last few months have driven home an important point: when I’ve felt sad about my aging body, an hour in a waiting room quickly recalibrates my self-pity perspective.

Hearing aids have improved my life, not just complicated it. I wish I’d stepped up to this reality a few years ago— and it’s an example of other aspects of aging.

My “waited too long” revelations are all too common. I’ve heard elders (older than me!) say they should have downsized into age-in-place housing years ago. Friends have shared that they waited too long for hip or knee replacements. I know many people who wish they’d quit tobacco or alcohol much earlier in life.

And yet I made the same mistake by resisting hearing aids.

My hearing is certainly better today, but my listening seems unimproved.

Pay attention to the parallels between pursuing better health and pursuing financial independence.

There are no affiliate links or paid ads in this post. Try your military base library or local public library before you pay money for these books– in any format.

Military Financial Independence on Amazon:

Raising Your Money-Savvy Family on Amazon:

|

- Reach your own financial independence

- Teach your kids how to manage their money

- Specific tactics from my adult daughter

- Checklists and spreadsheets for your family

Use this link to order from Amazon.com!

|

Related articles:

Why You File Your Veterans Disability Claim (Not Just How)