This seems counterintuitive, doesn’t it? Why would anyone want to celebrate their financial independence by making work better?

Of course you could quit paid employment as soon as you reach FI, but you might also decide to keep working as long as you find it challenging & fulfilling (and maybe even fun). Better still, the workplace is a great opportunity to… work on… shifting your mindset from the scarcity mentality (a frequent motivation behind saving & investing for FI) to one of greater abundance.

When you begin your journey to financial independence, you spend a lot of time & effort realigning your spending with your values. You also put your thoughtful effort into maximizing your savings rate without sliding across the line into deprivation.

Once you’re on track for your financial independence, you can start using some of your money to improve your life now instead of deferring your gratification until later.

It’s even better when you can use that money to boost your shipmates and your troops, not just your own life or your net worth.

A few years ago, a leader who ran the Dept of Defense’s Financial Readiness program spoke at a conference:

“Take care of your people. How do you want to be remembered by your troops? When they were struggling, did you reach out with your hand to that person and… throttle them? Or did you help them lift themselves up out of their problem?”

He says it better than I ever will, but over two decades earlier I used his idea during my career.

47 years ago (accompanied by thousands of other midshipmen) I memorized a ridiculous number of verses of “The Laws Of the Navy” written in 19th-century prose. One of them was:

“Dost deem that thy vessel needs gilding,

And the dockyard forbear to supply?

Place they hand in thy pocket and gild her,

There be those who have risen thereby.”

Let me disclaim that the poem is talking about buffing up the brightwork after the shipyard has already fixed the holes in the hull and replaced a few other essentials. You want to make sure they’re doing their job before you start spending your own money on improving your workplace life.

As long as you’re in uniform you’ll still have to work within the military logistics system (especially the financial and supply parts) to get the essentials of your success.

Yet once you’ve mastered the basics of your mission, there may be times when you can gild your own vessel. It’s a lot easier than grappling with the chain of command to convince them of your initiative and vision.

In the end, you might not even spend any of your money.

Here’s the sea story:

At the end of my career I was an instructor at a submarine training command. It was my second training command and I had five years of experience in military training management. (Those last three words are oxymoronic on several levels of chaos.) Coincidentally, my spouse and I had just reached our financial independence (assets of 25x our annual expenses, the 4% Safe Withdrawal Rate) by about 75 cents.

We were basking in the happy glow of accomplishing our goal, and we were both overflowing with the warm fuzzy feelings of FI gratitude & optimism.

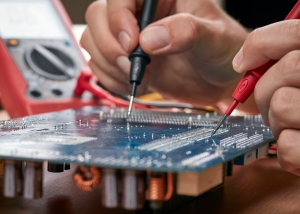

One of my training department’s courses was six weeks of microminiature repair for nuclear-reactor electronics technicians. (These were mid-grade sailors, usually E-5s with 4-6 years of experience.) It was a very intense class with 12-hour days and lots of hands-on repair labs. It was not only essential for reactor safety (and for keeping submarines on missions) but also an important promotion milestone. (“No pressure!”) We had a lot of demand for the course and there was a big spotlight on us to maintain a high graduation rate.

The course may (still) be taught at very few sites, which means that young adults have to travel from their homeport to one of the training sites.

If the military base’s barracks are full then the students are sent to an off-base hotel, and they’re also entitled to a food & transportation allowance. Our problem at the training command was that (for various reasons, usually last-minute schedule changes) many commands sent their students to Pearl Harbor without any advance travel funds– and sometimes even without a government travel card.

Servicemembers in their 20s (some with rudimentary financial skills) were expected to float the Navy’s travel expenses for six weeks before reporting back to their commands to file travel claims that take months for reimbursement… a process which has been broken for at least 40 years.

Even worse, the hotel was miles away from Pearl Harbor and the sailor was usually too young to rent an affordable auto. They could ride a bus (or a taxi) but the base gate was still several miles from our classroom. The galley was also a long walk from our building, and it was easier to pack your own meals… if you had the time, transportation, & money to shop for groceries.

By Day #3 of our training, it was pretty clear to our instructors which students had been sent to us without adequate funding. Students who are tired, hungry, and distracted are not learning.

At this point we’d drive the student over to the military base’s finance office for an advance on their travel expenses, but the finance office usually needed 3-4 business days to deposit funds in the student’s checking account. More time was wasted in getting grants from our local Navy-Marine Corps Relief Society.

I never succeeded in fixing any of those issues… but I was newly FI and I had discretionary cash. Back in 1999, just three years before retiring from active duty, I might have also had an attitude that contrition is easier than permission.

This logistics problem reminded me of a practice from both of my submarines. If one of our crew had too much to drink on liberty, we didn’t want them driving while intoxicated. Instead the boats’ Duty Chief Petty Officers had an envelope in their safe with $100. Taxi drivers all over the harbors knew that submarines would pay the cab fare of sailors who didn’t have enough liberty money left for the ride.

Of course most crew members were reluctant to use the program for fear of getting in trouble with the chain of command, but the Chiefs worked hard to lift them up instead of throttling them. In any case it was far better than getting a ride from Shore Patrol, or, even worse, the local police.

U.S. military officers aren’t supposed to lend money to junior personnel, and they’re prohibited from lending to enlisted. Yet they’re also trusted to manage multi-million-dollar budgets– and to spend cash from command funds.

I couldn’t fix the travel bureaucracy, but I knew how to fix a temporary cashflow problem. I could risk losing the money to gild my ship, too.

One morning I created my our department’s… official… Command Travel Reimbursement fund: I put $200 of my personal cash (crisp $20 bills) in an… official… brown Navy Department envelope and stored it in my office safe. I shared my plan with our chief petty officers (chiefs make the Navy run) and they agreed to to support the charade.

(Pro tip: in retrospect I probably should have told our Executive Officer about my initiative, although at the time I didn’t see the point of spending my time on the discussion. Refer back to my contrition & permission attitude.)

The CTR fund worked great.

The instructor would bring the student to my office and inform me they were taking them to get their advance travel from base finance. I’d open my safe, hand the envelope to the instructor, and say: “Here’s the Command Travel Reimbursement fund to tide them over. Please make sure they return the $200 when they get their advance travel funding.”

On the way to the base finance office, the instructor would reinforce this to the student. It was usually an E-6 or E-5 instructor telling a junior sailor something like “Nords really trusts us with this CTR fund, and it’s saved a lot of our students from failing the class. The travel system’s broken but he’s trying to fix it, and in the meantime we’d better not screw this up. Give us back the money as soon as you get the advance travel deposit so that we can help the next student in your situation.”

This continued flawlessly for the rest of my tour. The worst risk I ever took was $600. (It was a bad week for three students, and I needed all three envelopes.) The money always came back by the following week.

Once this system was in autopilot I moved on to solving other problems. However I’d neglected to consider the speed & power of the submarine sailor scuttlebutt network.

Our chiefs supported my fiction about the CTR fund, but they didn’t share that backstory with their other instructors. About two years into this scheme an instructor (from another department) was griping about their unfunded students to an instructor from our department. Of course they were outside of the hearing of their chiefs, and our instructor said “You guys should use the CTR fund— we use it all the time and it works great!”

Sure enough, a few hours later the XO overheard the talk about the CTR fund from another lieutenant commander. He’d been asked for access by his lieutenant, who’d heard about it from his chief, who’d received the request from a junior instructor.

The XO and I got along well, and we were both good at our jobs. He probably wasn’t surprised by my latest display of personal initiative, but he also felt that I’d jumped a little too far out in front of our command policy. The following week at our department head meeting, with a dozen other department heads seated around me, the XO looked down the table and waited for me to take a swig from my coffee cup.

With impeccable timing he said: “So Nords, please educate your fellow department heads about our Command Travel Reimbursement fund. I can’t seem to find that instruction in my file cabinet.”

I almost choked on my coffee.

As I wiped up the mouthful I’d just spewed on the table, I explained what I’d done and why it worked so well. The other department heads nodded and looked inquisitively at the XO. Maybe he used his own money for his CTR like I had, but I wasn’t going to ask. I kept using my money for our department’s CTR fund, and the XO never asked me about it again. Maybe the other department heads started their own CTR funds, but at least they didn’t ask me to subsidize them.

When I retired from the command, I left my $200 in our office’s safe and turned the system over to my relief. I included that reference to The Laws Of The Navy verse “Dost deem that thy vessel needs gilding…”

A few years after I retired, my cousin (an Army Ranger) graduated from another institution which made their cadets memorize at least as many ridiculous paragraphs of military trivia. During a quiet moment after the pomp & circumstance had abated (and before the celebrations started)… I mentioned The Laws Of The Navy poetry and handed him his own envelope (full of cash) to gild his first platoon.

I hope you can use my new tradition to help your troops help themselves. And if you’re also feeling the warm glow of abundance from financial independence, feel free to pass down your own traditions.

There are no affiliate links or paid ads in this post. Try your military base library or local public library before you pay money for these books– in any format.

Military Financial Independence on Amazon:

|

Raising Your Money-Savvy Family on Amazon:

|

Related articles:

Finding Your Military Work-Life Balance

Sea Story: “You Want HOW Much for that Stamp?!?”

Sea Story: Looking for an Engineer in All the Wrong Places