My spouse and I have been with Armed Forces Insurance for 44 years… starting with a personal-property policy way back when I was (unbelievably) a teenage midshipman.

It’s quite possible that their decades of low premiums and generous claims service have accelerated our financial independence by a year. We spent less for our insurance during the 1980s-90s and cut those expenses even further after retiring from active duty.

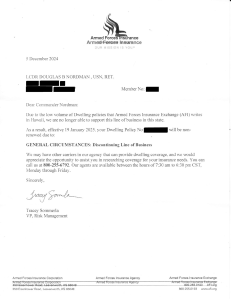

In 2025, though, AFI kicked us to the curb with barely six week’s notice. (Maybe it’s not personal: it’s just business.) They’ve told Hawaii that they’re pulling out of our market. Their retrenchment could be related to the catastrophic August 2023 Lahaina wildfire.

Are you one of the hundreds of thousands of Americans dealing with the insurance crisis? I’ll share our coping tactics at rebuilding our insurance.

Whatever AFI’s financial or risk-adjusted reasons for pulling out, their timing certainly destroyed our one-sided trust. During our four decades, 13 military moves, and five houses we only submitted two claims. Both were under $2500, and that second claim was nearly three decades ago.

We’re not risky clients, either. We don’t carry personal-property insurance, and we don’t carry collision or comprehensive insurance on our autos— only liability.

The really annoying part of AFI’s cancellation was that we’d just spent the back half of 2024 overhauling our policies. Our home, rental property, and umbrella liability were with AFI and our autos were with USAA but it had been several years since we’d shopped around.

We’re keenly aware that America’s insurance expenses are skyrocketing, and that national insurers are pulling out of several areas of the country. All of the corporations seem to be struggling with their claims ratios and they’re losing more money every year.

My spouse and I are not pinching pennies. We’ve saved tens of thousands of dollars with AFI over the decades, and today we’re not price-sensitive. However we feel that we invested hours of effort to negotiate with AFI in good faith, only (a couple months later) to have the rug jerked out from under us by a change of corporate policy.

The Process

In June 2024 we started all the insurance adulting. We:

- contacted five independent brokers for referrals and quotes,

- talked with several insurers about the details of our home & rental property,

- gave copies of our AFI policies & premiums to the interested companies,

- updated our replacement-value rebuilding databases with the companies offering the best quotes,

- requested manual underwriting for higher deductibles on hurricane insurance (because Oahu),

- researched a more realistic limit for our umbrella liability policy, and even

- considered minimizing our coverage of our rental property.

One broker responded with a warning:

“I reviewed the details of your current policies and my premiums were way higher than your current premiums. I have a suggestion regarding your current coverage: please increase your limits for the dwellings. Labor and material costs have increased over the last few years.”

Good advice. This is why we check our insurance every few years.

The worst part of this review was our rental’s 27-year-old cedar shake roof. In 1997 our homeowner’s association codes required this roof style, and national insurers had not yet declared cedar shakes to be a fire hazard. (Back then, clay tiles and aluminum shakes were expensive and even more problematic.) We keep the shakes in good shape (regular maintenance with spray coatings every four years), it still looks brand-new, and we expect to get another 20 years from it.

After a long discussion, AFI agreed to renew our rental’s policy with a limit of actual cash value for the roof (not replacement value).

Those rental-property discounts were our reason for renewing with AFI, and that facilitated our subsequent decisions to keep our home & liability policies with them… until the company decided to abandon Hawaii.

During our months of slogging through policy reviews, we checked with USAA about our real estate. We were only doing our due diligence, and we weren’t counting on them. They’d already pulled out of the Hawaii property insurance market in the early 2000s, and when they returned a decade later they were much more expensive than AFI.

In 2024 USAA’s app immediately shot back:

“We are unable to provide you an insurance policy because of an increased exposure from coastal storm-related damages.”

Well, yeah, that’s because *every* storm on our 30×40-mile island is coastal, even when we’re in the center of that landmass. But that bot’s boilerplate probably applies to all three coasts on the Mainland too.

I called USAA’s member service representative, and they clarified that they’d be willing to insure our home because it was built in 1989 and upgraded in 2011 with hurricane-resistant hardware. However our 1979 rental with its 27-year-old shake roof would have to be laid off with their specialty-insurance partner: American Modern Insurance.

Just to be clear, AMI is not related to American Family Insurance. AMI is a boutique subsidiary of Munich Re and has a pretty good track record of insuring older (problematic) homes.

However by this point Armed Forces Insurance was quoting premiums of $1300/year while USAA and AMI were closer to $3000/year.

As I expanded our search, I contacted our local State Farm agents. Their e-mail quotes were lower than USAA but still higher than AFI.

During our research I learned that Costco offers insurance from affiliate companies. After entering our property ZIP codes into Costco’s site:

“Thank you for your interest in getting an insurance quote with us. We are unable to provide an online quote for you through Costco CONNECT. However, we have established relationships with other reputable insurance carriers and would be happy to help you find coverage with one of them.”

Hey, at least Costco is trying to send us an affiliate link. Yet when I phoned Costco’s call center, they said they’re not offering property insurance in Hawaii. “Never mind.”

If there’s anything good about the months we spent on our insurance review, it’s that (like any good nuclear-trained submarine veteran) I’d built a spreadsheet summary of our research.

When AFI bailed on us, I went back to that spreadsheet and started the tab for Plan B.

Oh That Was Fun. Let’s Start Over And Do It Again.

By the time we finished negotiating earlier in 2024, AFI had hiked our home’s comprehensive insurance premium by 17% (to $1326/year) and our rental’s landlord “named perils” policy premium by 30% (to $1292/year). Annoyingly, they’d insisted on their standard 2% hurricane deductible instead of our request for a 5%-10% deduction. We’re happy to shift some of the risk to us owners, but AFI didn’t want to spend the time or money on the manual underwriting.

A couple of months later that deductible debate felt moot when they sent us the cancellation letter on our home policy. We became skeptical that AFI would renew our rental’s policy, too… and if they wouldn’t insure our real estate then they wouldn’t renew our umbrella liability policy either.

We were happy to re-engage with USAA, especially for their military affinity. It also makes sense to coordinate home, auto, & liability policies with a single insurer so that a catastrophic loss doesn’t involve negotiations with 2-3 separate companies.

However I’d felt a similar affinity with our local State Farm agents, a couple who literally live in our neighborhood, and the company has a good reputation in Hawaii. After a few e-mail exchanges, we updated our properties in their database and got a more precise quote for adjusted rebuilding costs and revisions to the construction codes. We’ve kept up with local building codes but if a big hurricane hit the island then construction contractors would be in very high demand while materials would be scarce.

For $2505/year our home would have State Farm’s deductible of 5% and a hurricane deductible of 10%.* That’s 90% higher than AFI yet still cheaper than USAA. Better yet, State Farm does a lot of business on Oahu and seems less likely to abandon us like AFI or USAA.

(*We really wanted a higher deductible because our home has a newer shingle roof that’s covered with photovoltaic & solar-water panels. We can DIY repair any shingle damage from a CAT 3 storm.)

For $1541/year our rental property would have a deductible of 3% and a hurricane deductible of 5%. That’s 20% higher than AFI’s renewal but… we’d be insured for a 27-year-old shake roof and we have a long-term landlord plan for a 2040ish rehab.

I was pleasantly surprised with State Farm’s user-friendly website. Their app is not as robust as USAA’s world-class member service, but both insurers’ apps have dramatically streamlined their claims process. AFI’s website looks like it was last overhauled in 1998, with bare-bones navigation.

AFI billed on something like a four-month payment plan for each of their separate annual policies, which meant that we could only predict the annual totals. The monthly ACH transfers for those bills fluctuated by several hundred dollars.

State Farm bills on a 12-month schedule, so we know today that our next year of property premiums will cost a consistent $338/month.

Our First Attempt At Umbrella Liability Insurance

Our next step with State Farm was a $4M umbrella liability policy (on top of our home & auto liability coverage). The agent readily admitted that he could only approve $2M without additional underwriting, but he was confident that State Farm would approve $4M.

That was good enough for our next step: ditching AFI.

We took State Farm’s $2M binder while awaiting underwriting approval for $4M. Once my spouse and I checked over the three policies we were ready to talk to AFI.

“No, We’re Not Canceled, *You’re* Canceled.”

I have to admit that I fantasized a few times about calling AFI to cancel our accounts.

I hadn’t talked with them since last September (when we updated our policies) and I certainly wasn’t going to call them about their December cancellation letter.

I was quietly hoping (against hope) that this was all a horrible mistake. Maybe they’d reversed their decision, or they’d meant to only cancel beachfront properties, or their retention team would negotiate a different policy with higher deductibles.

I certainly wasn’t going to argue about their decision or beg for reconsideration, but I was willing to be persuaded.

I poured a fresh cup of coffee, Bluetoothed my hearing aids to my iPhone, logged into AFI’s website, made the phone call, and… ended up in their call center’s hold queue. This was fine.

The member service rep came on a few minutes later and went through the usual identity verification. When they began asking questions about updating our records, I politely interrupted that we wanted to cancel all of our AFI policies.

Them: “I see we’re already declining to renew your homeowner’s policy.”

Me: “Yes. Please cancel that as of today. Please also cancel our rental property policy, our liability policy, and our umbrella liability policy. We’d appreciate it if you’d refund us the unused premiums.”

Them: (keyboard clicking) “I’m sending you the confirmations now. You’ll have to Docusign them to verify that you’re canceling.”

Me: “When will that take effect?”

Them: “As soon as you finish the Docusign. We’ll refund your unused premiums. Will there be anything else?”

Me: “No thank you, I’ll watch for the refunds.”

Them: “Yessir. Thank you for calling. [click].”

Our conversation was professional yet notably free of empathy– let alone any retention discussions or offers to refer us to other insurers.

Maybe the rep was burned out from handling all of the other Hawaii policy cancellations? Or maybe the call center didn’t even know about the corporate decision to “discontinue the Hawaii line of business.”

44 years of history ended in less than 10 minutes… just like that.

Two weeks later, I still can’t tell that AFI is issuing any premium refunds. We’ll give them another couple weeks to honor their commitment.

AFI’s refund check ($75.95) arrived on Day #17.

The Liabilities of Umbrella Liability Insurance

Unfortunately we learned that we weren’t quite finished talking with insurers yet.

State Farm’s auto insurance couldn’t compete with USAA, and then their $4M umbrella liability policy came in at $1476/year. That was nearly double what we were paying AFI for a $5M umbrella liability policy.

Even the State Farm agent thought $1476 was high. Upon further research, it was because State Farm wasn’t insuring our autos and couldn’t give us a consolidated discount. It was also one of the highest umbrella liability limits that they were willing to underwrite.

The reason we were even considering buying ridiculously high limits of $4M-$5M was because Oahu real estate has been appreciating at a compounded annual rate of 5%/year for over two decades. We can do math, and we wanted to get this policy in place before we had to renew our driver’s licenses in our 70s.

I was also making the (flawed) assumption that we’d want to have umbrella liability coverage for our (future) gross worth. I thought that judges and juries would routinely impose damages at that level, and we’d need to insure for it.

I was wrong.

It turns out that the vast majority of liability suits don’t even get to court, and (short of a felony) multi-million-dollar judgments are rare. $3M would be plenty conservative for our current needs and at least the next decade. $4M was overkill, let alone $5M.

Sure enough, State Farm was ready to pry us loose from USAA with a financial crowbar.

If we left our auto insurance with USAA then we’d pay:

USAA annual premium + State Farm $4M umbrella liability = $961 + $1475 = $2436/year.

If we moved to State Farm for both then our premiums dropped by 19%:

Auto + $4M umbrella liability = $1241 + $738 = $1979/year.

If we reduced the State Farm umbrella liability to a slightly more reasonable limit then:

Auto + $3M umbrella liability = $1241 + $606 = $1847/year.

A rigorous comparison would reduce USAA’s $961/year premiums by their $100-$150 distributions from their Subscriber Accounts, but that annual rebate is unpredictable and could drop to zero if USAA’s claims year is especially bad.

Even so, insuring everything with State Farm and dropping our umbrella liability to $3M would reduce our annual premiums by 25%.

I was ready to send the e-mail, but at the last minute I realized that I was overlooking a different move.

We’d only considered quitting USAA’s auto insurance because AFI is backing out of the Hawaii property market. It wasn’t USAA’s fault that we had to find our umbrella liability insurance somewhere else.

With that epiphany, I went over to USAA’s site for a quote on umbrella liability.

USAA auto + USAA $3M umbrella liability = $961 + $527 = $1488/year.

39% is a heck of a consolidation discount over State Farm.

It’s a bit unusual (and very gratifying) to see that USAA offers umbrella liability even if we only insure our autos with them, and not our real estate. Considering USAA’s real estate premiums, I’m surprised that they’re cheaper for umbrella liability than both AFI and State Farm.

USAA wants nothing to do with Hawaii homeowner’s insurance, but apparently they’re willing to get paid to accept the risk of people slipping and falling on our wet driveway.

Better yet, USAA is still (as usual) much cheaper for auto liability than other insurers. Dropping collision & comprehensive has saved us tens of thousands of dollars over the decades. Not having C&C on our cheap used cars has also accelerated our financial independence!

I checked with the State Farm agent again, who already knew that USAA has lower umbrella liability rates. (Not that he was required to volunteer that detail.) I confirmed that we can have our homes with State Farm for these prices while we do auto liability & umbrella liability with USAA. He responded:

“There is no discount on your home or rental dwelling for having the umbrella policy with State Farm. The homeowners would get a discount for having car insurance with us.

You are correct the biggest discounts are on your auto policies. You should definitely keep your umbrella and auto insurance with the same company to maximize the discounts for those two policies.”

10 minutes later, USAA’s app issued us a $3M umbrella liability policy. (No phone calls required.) I e-mailed State Farm to cancel our umbrella liability policy, and we promptly received their confirmation.

We’re still split between two insurers, but USAA doesn’t compete with State Farm on Hawaii real estate– and State Farm can’t compete with USAA on Hawaii auto liability. If they get along then I sure hope this reduces the hassle factors from a possible large claim with both.

I’m very relieved to put this seven-month insurance saga behind us.

Your Call To Action

I recognize that people are paying far more for insurance in their ZIP codes (if they can even get the coverage they want) and I’m not complaining about our new premiums.

But if this happened to us– 40-year customers in our 60s– then it could happen to everyone facing damage from winds or fires.

We’re done with Armed Forces Insurance and we’re not goin’ back, but if you’re still with them then I’d check their annual report to see if their reserves and claims loss ratios raise any financial concerns with you. (And maybe you’d want to build your own quotes spreadsheet from other insurers.) We’ve generally been happy with their customer service over the years, but their Hawaii exit is clearly a financial & risk control. Customer loyalty does not seem to be considered.

And self-insure whenever you can afford the risk!

(P.S.: Once again I’d like to thank the mentors and other members of the Millionaire Money Mentors forum. The information they shared during our insurance research helped us make the right choices for the right prices, and their feedback also helped write this blog post. If you’re already a member there then you can read more of those threads by searching the forum for the phrase “American Modern Insurance.”)

There are no affiliate links or paid ads in this post. Try your military base library or local public library before you pay money for these books– in any format.

Military Financial Independence on Amazon:

|

Raising Your Money-Savvy Family on Amazon:

|

Related articles:

“Do I Really Need Servicemembers Group Life Insurance?”

How Much Life Insurance Do You Need?

Your Auto Insurance Premiums Are Rising, But It’s Not Just You

Why I Won’t Buy Long-Term Care Insurance

USAA Answers Your Insurance And Financial Questions

20 Years Of Financial Independence & Military Retirement

Not surprised with your story….had a heck of a time getting home insurance in FL when moving back to USA. USAA finally insured my new to new state specs (mainly roof build) house in the middle of the state….BUT, had to wait for someone to rotate off their insurance list in FL….some of these conversations with companies are quite odd nowadays. Rode through both hurricanes last summer (those 100 year category 4 ones with Milton ripping across center of state)-no damage, no claim. Frankly I haven’t had a claim in decades and none for any houses…

Yep. I think insurance companies are completely overhauling their risk assessments, especially in concentration areas and in the vicinity of supercat natural disasters.

That’s essentially forcing the states to step up and provide coverage as a last resort, and out of their tax revenues.