Military families ask a frequent question about financial independence:

“Hey Nords, what stocks should we buy?”

It’s a trick question. Before people start picking investments, the first step is deciding on an asset allocation. Yet the responses quickly devolve into a debate of the merits among commercial real estate, Nvidia, and cryptocurrencies.

Logic + math versus emotions

The key is not just picking an asset allocation that will optimize your returns, but also picking one that you’ll be willing to stick with during the volatility of a plunging bear market and a nasty recession. (Nobody complains about the volatility of a rising bull market.) The right asset allocation (right for you!) feels comfortable and helps you sleep better at night– especially if it helps your spouse sleep better at night too.

If that “comfortable sleep” priority isn’t met, then nothing else matters. If it doesn’t “feel” right, then the emotions of behavioral financial psychology will always derail a highly logical asset allocation plan.

Then there’s decision fatigue.

If you have to keep making the same investment decisions over and over again, whether they’re easy or hard choices, then you’ll deplete your cognitive stamina. Even worse, you’ll abandon the entire decision-making process and end up with minimal retirement savings.

If you’re lucky, your excess cashflow has piled up in a savings account while you dither on your choices. Or the money could slip through your fingers.

Think about the people you know who haven’t started budgeting, saving, or investing. Maybe they’re not even paying down their credit-card debt or their student loans. Yet they seem like functional adults. Are they really that incompetent with money? (They can do math, right?) Why aren’t they moving their assets?

Or are they just feeling tired and defeated every time they contemplate the numbers, and paralyzed by indecision?

What the heck does this squishy pop psychology have to do with picking an asset allocation?

Understanding your emotions helps you build a plan that you’ll stick with through good markets… and in tough markets.

Better yet, your plan makes it a lot easier to automate your investing and minimize your decision fatigue.

Your chosen allocation has to give you the patience to keep buying shares when the market drops 30%. It has to support your discipline to ignore the hysterics of the financial media and persevere with your plan. It has to give you a written document (or an affirmation on your phone, or a Post-It on your refrigerator) to override short-term panic and to visualize your future financial freedom.

Over the long term (>10 years) you’ll grow more wealth with steady (automated!) dollar-cost-averaging into your asset allocation.

You won’t have to feel (there’s that emotion again) obligated to try to time the market.

Stocks or bonds?

Waaaaay back in 2008, Moshe Milevsky’s book “Are You A Stock Or A Bond?” suggested designing your asset allocation to complement your occupation. Over a decade later his thoughts are still relevant to your life stages and investments.

What’s a career look like as a stock?

Well, if you succeed as a professional athlete, or as a big swingin’ Wall Street trader, or as a full-stack developer tech nerd (you know who you are) then your occupation is likely to have high earnings for a few years. The vast majority of rockstars in this category have big payouts, but they tend to be for less than a decade. They might face frequent layoffs or even firings. Their reliability of continued employment is low and their financial uncertainty is high.

Just like picking a stock, their careers might be highly volatile with a risk of a loss of principal.

Take a look at the bankruptcies of NBA basketball players, the movie tropes of Wall Street traders, or the tech industry’s layoff cycles. The income might be awesome while it lasts, and the lifestyle looks exciting from the outside, but the net worth… not so much.

As thrilling as it might be to earn (and spend) those staggering sums of money, there’s no guarantee that your career will end on your terms. You might not even vest in your stock options, let alone in your pension.

Instead, Milevsky suggests offsetting a volatile high-earning career with investments that are high in bonds, Treasuries, and even single-premium immediate annuities.

On the bond-career side there are civil servants, university professors, and military families. The starting salaries are low and the raises are small, but their careers generally have a higher likelihood of continued employment. Persistence is usually rewarded with promotions, and there are retirement investment accounts. Better yet, some of these occupations tend to have untaxed compensation, employer’s matching contributions, annuity income, or even decent pensions to supplement a few decades of saving & investing.

Your bond career won’t get you rich quick, but you’ll have time and compounding on your side. Some of those professions have a much better work/life balance, too.

Milevsky suggests that people in reliable, lower-earning careers should invest in an asset allocation which is high in equities. As long as you expect steady employment, you could even go as high as 90%… if it feels right.

The 4% Safe Withdrawal Rate (and the Trinity Study)

These two historical computer simulations ran through many different combinations of stock & bond asset allocations. They’re limited in the scope of their simplistic asset studies: large-cap stocks and government bonds. They did not include international equities or real estate, and cryptocurrencies didn’t even exist yet.

However this research consistently contrasted volatile assets that are highly likely to beat inflation (stocks) against less-risky assets that reduce volatility without consistently beating inflation (bonds).

None of the withdrawal rate simulations include Social Security, pensions, or annuities. Those benefits were beyond the scope of their research questions. Besides they’re hard to add to a computer model, so both the original 4% SWR study and the Trinity researchers ignored them.

Despite the limits and omissions, these studies answer the most important question of your career: how long do you need to keep trading your life energy (finite yet uncertain) for financial security? When do you have enough?

Even more importantly, when will you reach the point of trading life energy (which you might not have) for money that you won’t need? When does your safety margin become ridiculously excessive?

If the 4% Safe Withdrawal Rate has a very high probability of lasting for at least 30 years with assets of 25 times annual expenses, then why would people keep working for 33x, 40x, or even 50x?!?

Extra assets get back to those emotions of behavioral financial psychology. Words like “security”, “enough”, and “safety” are loaded with feelings. We can be highly logical and do all of the math, but if we don’t feel good about the results then nobody will be happy enough to stop working for paychecks.

Yet nobody is happy about working for paychecks until they die, either.

How much of each asset class?

There’s a growing body of research data to support an asset allocation that’s higher in equities (to beat inflation) with some bonds (to reduce volatility).

Most of that research is based on over a century of data for large-cap stocks. The S&P500 is a popular index, and more recent data comes from total stock market indexes that cover a much wider variety of company sizes.

The asset allocations analyzed for the 4% SWR & Trinity studies were at least 50% large-cap stocks and the rest in Treasuries or corporate bonds. Depending on your career, your life stage, and your tolerance for volatility– you could go up to as high as 100% equities.

Bond ratings and durations will affect their yields (and make investors feel sad when those yields drop) but the main reason for bonds is reducing overall volatility of your investments. Once you’ve lowered volatility, there’s no reason to chase yield— especially if a higher yield (from a riskier bond) raises that volatility again. Even if your bonds have a lower yield, your stocks portion of your asset allocation does the real work of beating inflation with higher yields.

It doesn’t matter whether the bond yields match inflation or lag it. Bond duration doesn’t matter, either, especially if they’re in an index mutual fund or exchange-traded fund being held for at least five years. It probably doesn’t even matter whether they’re Treasuries or junk bonds, as long as they reduce overall volatility and don’t default.

Picking the actual asset-allocation number can be tinkering at the margins, but any stock/bond asset allocation between 60/40 and 90/10 has been generally proven to last for at least 30 years. (Allocations with more stocks are more volatile.) Pick numbers in that range which help you sleep best at night.

Your choices could be as simple as one total stock market fund and one total bond market fund. Both of them should be passively managed and have low expense ratios. If you buy exchange-traded funds then you can hold them at nearly any brokerage instead of paying extra fees. For example the Vanguard total stock market index ETF (ticker symbol VTI) trades commission-free at other brokerages.

If you must pick stocks, then limit your overall asset allocation of individual stocks to no more than 10%. That’s big enough to move the needle on your net worth if you turn out to be a brilliant investor, and small enough to limit the damage when you’re… not.

Other asset classes?

“But what about real estate?” Sure, if it makes you feel better (there’s that emotion again), but nobody has shown that real estate is absolutely necessary. There’s more research about stocks & bonds than about real estate, so this is a question of comfort (and volatility) instead of strictly asset allocation.

An investment property probably appreciates at least at the rate of inflation and has a yield of at least a high-quality dividend stock or a corporate bond. The leverage of investing with cheaper mortgage money is the stock-market equivalent of buying shares on margin. You could replace some of the stock asset allocation with an equivalent value of real estate.

We’re just exploring how hard you want to work at managing properties (landlording, REITs, syndications, or anywhere in between) and how well you’re sleeping at night.

“But what about alternatives?” Sure, if you can tolerate the volatility. Again: nobody knows if alternatives (including cryptocurrencies) are absolutely necessary. There’s not enough history for confidence in the statistics over a 30-year period.

In this case, I’d limit the asset allocation for alternatives to 10%. See the comment above about brilliant investors… or not.

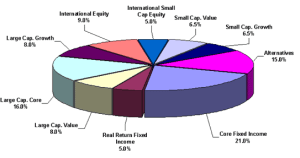

If your asset allocation percentages are measured with increments of less than 10 percentage points then you’re probably overthinking it. Nobody knows that either. At smaller numbers like “6.82%” you’re just tinkering at the margins and giving yourself more busyness to track.

There’s no single perfect asset allocation for anyone, but there are plenty of good-enough asset allocations. You could go with the cake & fruit salad theory, or some variation of your age. The important part is picking an assert allocation and investing in it instead of being paralyzed by a perpetual quest for the best asset allocation.

Once you’ve started investing in your asset allocation, and put it in autopilot with periodic deductions & share purchases, then you can step back and consider whether it’s worth your time to seek a better asset allocation.

What’s next?

Use the 4% Safe Withdrawal Rate as a tripwire for your financial independence.

Once you reach assets of 25x your annual spending (25x is the inverse of 4%), your investments are very highly likely to last for 30 years.

“Tripwire” means that you could decide to keep working if you find your career challenging & fulfilling. You could stop working and go full-throttle FI lifestyle if that’s your plan (and if you’ve been preparing for that new life). If you’re not ready to quit work then you could negotiate part-time hours, work from home, remote work, more paid time off, a sabbatical, or simply an unpaid leave of absence.

You could even start searching for a different job that meets your new standard of work/life balance and your desired quality of life.

If you qualify for Social Security, that income stream drives your portfolio survival to 100%. Social Security was never included in the Bengen SAFEMAX 4% SWR research or the Trinity Study. It’s extra.

For the first decade of financial independence, you can minimize the risk of an adverse sequence of returns by keeping about two years’ expenses in cash. Replenish the cash stash after years when the stock market is up, and keep spending it after years when the stock market is down.

Two years does the job well enough to minimize this sequence of returns risk, although some bear markets & recessions might last longer. We’re not trying to outlast the bear market or recession– we’re trying to keep just enough cash to avoid portfolio failures.

If the recession lasts longer than two years then you might have to sell bonds or stocks at lower values, but you’ll still probably be able to offset capital gains & losses in a tax-efficient manner. Better yet, your investments avoided worse damage during the first two years and are two years closer to a recovery. You’ve survived the sequence of returns risk.

Is there a better number than “two years”? What about four years of cash? 37.8 months? That answer depends on whether we’re back to sleeping well at night.

How much longer do you want to trade your limited life energy for money that you won’t need?

After a decade of financial independence, while your asset wealth grows faster than your original inflation-adjusted withdrawal rate, the actual withdrawal rate drops. Economist Karsten Jeske’s research has shown that SORR is negligible when the withdrawal rate drops to around 3.25%… and when there’s no SORR, then that withdrawal rate is sustainable for at least 60 years. (Parts 38 and 54 at that last link.)

Finally, anyone who’s receiving annuity income (particularly inflation-adjusted annuity income!) can hold an asset allocation that’s lower in bonds (and higher in stocks). That’s because an inflation-fighting annuity (like a military pension or Social Security) is the equivalent of the yield from a fund of low-volatility high-quality TIPS or I bonds. That’s a flawed analogy in some ways (because bonds mature) but it’s acceptable for a discussion about asset allocation.

This analysis has led recent financial researchers to propose asset allocations like Wade Pfau’s review of variable-spending strategies, or Michael Kitces’ “rising equity glidepath.”

None of this discussion addresses rebalancing. Do whatever helps you sleep better at night, but every 2-5 years or +/- 10 percentage points is probably good enough. We don’t have enough research to be confident that rebalancing is necessary.

Call To Action:

1. Decide on your asset allocation with a percentage of stocks & bonds between 50/50 to 90/10.

2. Get started by automating it! Use payroll deductions to your 401(k), and deductions from your checking account to your IRA. As your income rises, deduct even more from your checking account to taxable accounts.

3. Make sure that those accounts (your 401(k)s, IRAs, and taxable accounts) are invested in your asset allocation. Pick passively-managed index funds with low expense ratios, and reinvest the distributions.

Once you’ve automated the investments (and the reinvestments), you can dig deeper into this post’s links and consider tinkering with your long-term asset allocation. As your wealth grows, maybe you’ll choose to add other asset classes– but it’s not essential.

The good news is that your investments are quietly compounding away for your financial independence, whether or not you finally find your perfect asset allocation.

There are no affiliate links or paid ads in this post. Try your military base library or local public library before you pay money for these books– in any format.

Military Financial Independence on Amazon:

|

Raising Your Money-Savvy Family on Amazon:

|

Related articles:

Jim Dahle’s “150 asset allocations better than yours”

Mike Piper’s asset allocation: fruit salad

“How Should We Plan Our Finances For The Rest Of Our Lives?”

Financial Myths Of Retirement

Ben Carlson: “A Balanced Portfolio Always Comes With Regrets”

The Bogleheads Wiki on asset allocation